Information regarding various disciplines and techniques including: geochemistry, geochronology, geophysics and marine surveying.

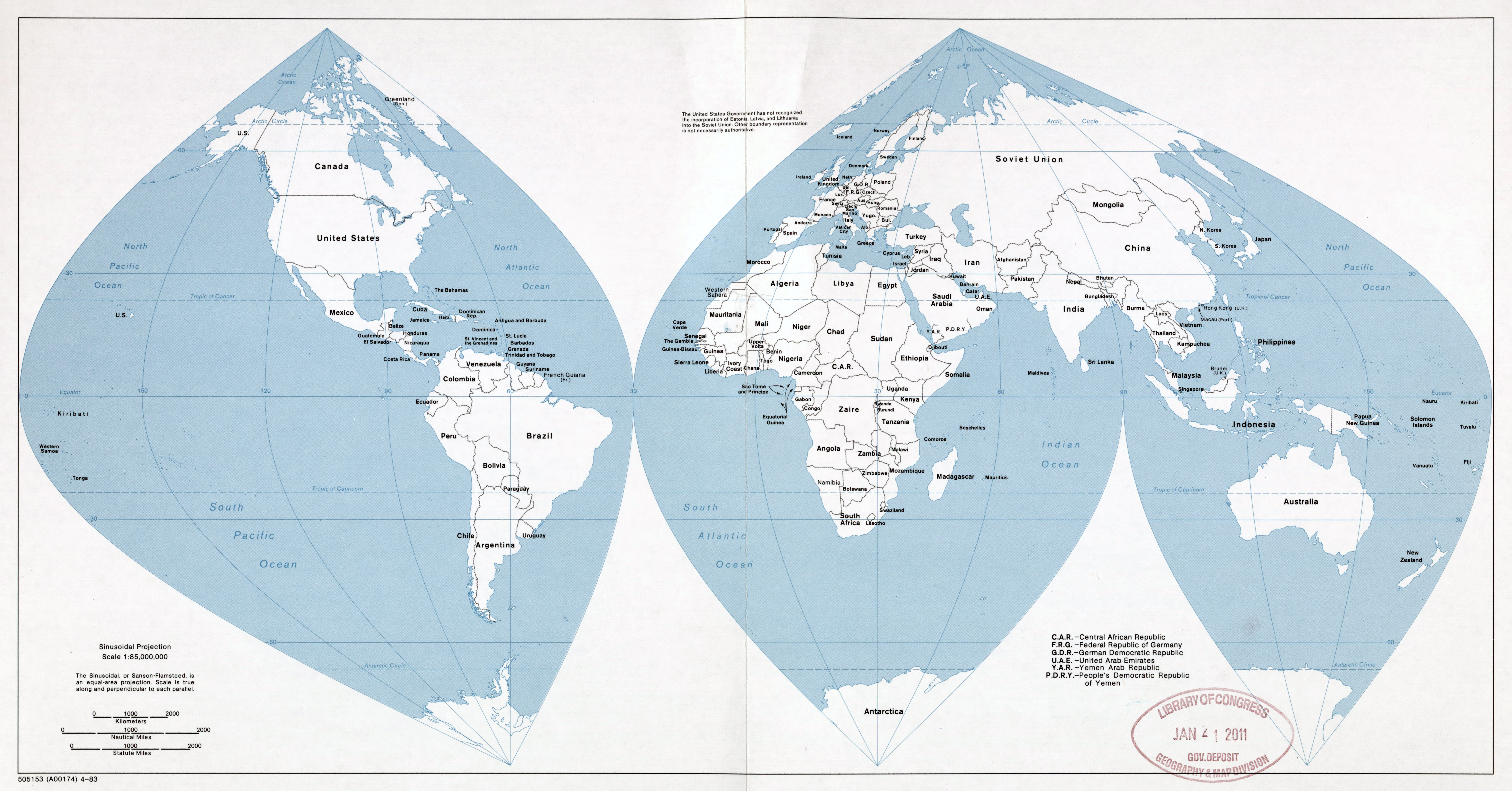

Actual map of the world software#

Our products include almanacs, software and web services providing precise astronomical data. Even though I'd likely pay more to the DOE in that time I could avoid the hassle/cost of filing separately and pay my loans down somewhat in case PSLF doesn't work out or becomes a tax bomb with changes to the forgiveness in the next 10 years.Leaders in Earth science data, bringing the benefits of space to all Australians. Am I missing some major component in that assessment?Īt this point it seems like just biting the bullet and committing to REPAYE despite any hypothetical spousal income may be my best option. Even though I'd likely pay more to the DOE in that time I could avoid the hassle/cost of filing separately and pay my loans down somewhat in case PSLF doesn't work out or becomes a tax bomb with changes to the forgiveness in the next 10 years. IRS) due to the tax hits associated with filing separately, is that right?Īt this point it seems like just biting the bullet and committing to REPAYE despite any hypothetical spousal income may be my best option. Lots and lots of hypotheticals there but from your response above in this scenario it sounds like I'd just be shifting where I pay that extra $50k (DOE vs. If I moved to the REPAYE plan and file taxes jointly with a hypothetical spouse at the same projected income the last 5 years I'd pay ~$110k to the DOE and have my remaining loan balance be ~$140k. If I stay on the PAYE plan and then file taxes separately if I get married in 5 years (just to model how this would work) I'd pay ~$60k to the DOE over 10 years, and my loan amount would balloon to ~$200k. I've been modeling a few situations to pick the right plan moving forward (just entered repayment). With my projected academia/non-profit income I would never exceed the Standard 10 year repayment plan amount and may not ever even exceed the monthly interest accruing on my $160k debt (ugh) by myself. I'm planning/hoping on utilizing PSLF for forgiveness in 10 years. Associate looking to own your own practice one day and possibly repaying the debt with a higher income -> REPAYE So in short, long term corporate associate with >500k debt -> PAYE. If you use REPAYE to keep the debt growing more slowly, then there's a more viable path available if you suddenly had a huge income from owning your own practice bc the debt would be smaller. Also, PAYE is better suited to folks who never plan on being a practice owner. The upside is PAYE has a 20 year forgiveness term.įinancially, PAYE seems to come out as having a lower cost when taking into account inflation and the future value of money, however it's a higher risk option. PAYE is good for getting the debt resolved sooner, but it will always result in higher forgiven balances on which you'll pay tax compared to REPAYE bc PAYE has no interest subsidy.

The downside is its a 25 year repayment term until forgiveness. The REPAYE option is good for keeping the balance lower and under control bc it has an interest subsidy.

0 kommentar(er)

0 kommentar(er)